Diving into the world of stock trading and financial markets can be both exhilarating and daunting. Among the myriad strategies, one fascinating concept stands out: the implied move of a stock on earnings. But before we dive into options lets review the foundation of what options are

Call and put options are two types of financial derivatives that provide the holder with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) within a specific period of time (expiration date).

Buying Call options are typically used by traders who expect the price of the underlying asset to rise, while buying put options are used by those who anticipate the price to decline. Both options provide opportunities for hedging, speculation, and risk management strategies in the financial markets.

The most commonly used strategy to understand Implied earnings move is a complex option strategy called a straddle.

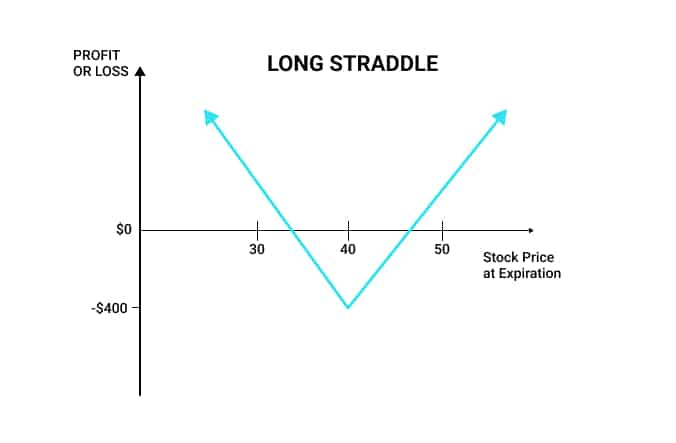

Option straddles are investment strategies used in financial markets to profit from significant price movements in an underlying asset. In a straddle, an investor simultaneously purchases a call option (giving the right to buy) and a put option (giving the right to sell) with the same strike price and expiration date. This strategy is employed when the investor anticipates a substantial price fluctuation but is unsure about the direction; such as an earnings release.

If the asset's price moves significantly upward, the call option generates profit, while the put option may expire worthless. Conversely, if the price moves downward, the put option generates profit, and the call option may expire unused. The goal is to profit from the substantial movement regardless of the direction.

With the knowledge of options and the strategy that are used we can now look at how to calculate and understand implied move on earnings. The implied move on earnings refers to the estimated potential price range within which a stock is expected to move following an upcoming earnings announcement. It is derived from options’ pricing and represents the market's anticipation of volatility surrounding the earnings release. By analyzing the premiums of at-the-money call and put options, (the straddle we just learned about), traders can calculate the earnings implied move.

For example, if the call option premium is $2.50 and the put option premium is $3.75, the implied move would be $6.25. This suggests that the market expects the stock move on earnings to be approximately $6.25 in either direction following the earnings announcement.

However, it's important to note that the implied move on earnings is an estimate and not a guaranteed prediction of the actual stock price movement. Actual market conditions, unexpected news, and other factors can influence the stock's behavior, leading to deviations from the anticipated range. Traders often use the implied move on earnings as a reference point for making informed decisions regarding options strategies or risk management surrounding earnings events.